5 Reasons for the Recent Crypto Price Dip and Bounce Back

Jack Choros

Content Marketing

Welcome to another edition of Netcoins Progressive Investor.

In today’s edition, we’re going to go over five reasons for the recent dip in cryptocurrency prices the market is seeing and why the price bounced back so quickly after the fact.

The insights you glean from this post will put into context in a broader sense exactly what’s going on.

By now you should know that seeing 30% to 40% swings in the value of your crypto assets is pretty commonplace, but then again, perhaps the bull run that has dominated both the cryptocurrency and traditional financial markets over the past year has you a little too comfortable in your positions.

Either way, the crypto market is bound to cool off at least for a little while, but in this post, you’ll realize that not much has changed in terms of the fundamental value of crypto’s top projects.

Without further ado, let’s dive into why crypto prices have been so choppy lately.

Investors Are Still Long on Crypto; the Fundamentals Haven’t Changed

Michael Novogratz is a Canadian businessman who runs one of the largest publicly traded blockchain firms in the industry, Galaxy Digital Holdings. Novogratz recently appeared on the popular crypto podcast, Unchained by Laura Shin, and he broke down five reasons why crypto prices have been shooting up and down over the last month or two.

The first reason Novogratz brings up is that more people are long on cryptocurrencies than the market truly understands. In other words, more and more retail and institutional investors wait on the sidelines for dips in price and then buy more crypto.

The more and more this happens it creates a higher price floor for cryptos, particularly the top guns like Bitcoin and Ethereum.

Keep in mind that nearly 75% of the $1.2 trillion Canadian that is invested in cryptocurrencies is only in the top four projects by market capitalization.

Investors are buying the dip like never before.

Capital Gains Taxes Is Lending Momentum to the Seesaw Battle

Tax deadlines naturally force many investors to take money out of the market to meet their obligations. Of course, if you’re making money off of investments, oftentimes you’ll be obligated to pay capital gains taxes.

If you use your income to pay your bills and pay your income tax, that means you don’t have as much money to invest once you pay taxes on your capital gains.

Novogratz and others believe that while investors are scrambling to meet those obligations, they are pushing the market up and down as taxpayers withdraw from cryptos, and savvy investors waiting to buy the dip start buying back in.

Institutional Investors Are Taking Profit

Imagine that you are an institutional investor waiting for the right time to make a big splash with a sizable cryptocurrency investment. When was the best time to do that over the last year and a bit? Well, of course, the beginning of the global coronavirus pandemic.

That’s exactly what institutional investors did! Consider that in March 2020 a Bitcoin was selling for less than $7,000 Canadian. If you start from today and work backward two months on a Bitcoin price chart, you’ll see that the all-time high occurred on April 14, and on that day, Bitcoin stood at nearly $80,000 Canadian.

Think about the fact that you may only have the money to buy one full bitcoin at $7,000. How happy would you be to cash out more than 11 times your money 13 months later? My guess is you would be incredibly happy.

Here’s the thing. Using only a $7,000 investment, you might want to keep your one Bitcoin and forever be known as one of the early adopters that owns a full Bitcoin when it hits the million-dollar mark.

Now imagine that you’re an actual hedge fund billionaire who bought 10,000 Bitcoins at $7,000 each, which is a $70 million investment?

13 months later your investment is worth close to $800 million. You’re not going to keep that investment for another 10 years, are you?

This is exactly where big-time investors like Paul Tudor Jones, who only started investing in crypto over a year ago, find themselves.

With the kind of profit they are making, they would be foolish not to cash out some of it.

Elon Musk Changes His Tune

Tesla founder Elon Musk began tweeting about Dogecoin last year. His tweets began an investor rally on Reddit and other social media platforms that nearly pushed the meme coin to a valuation of one dollar Canadian earlier this spring.

That’s insane when you consider the fact that a single Dogecoin was worth just $0.06 cents Canadian in February. Even with the price sitting at $0.40 at the time of this writing, Musk is facilitating a huge return on investment for people who followed his tweets.

But that’s not the only thing Musk did that helped pump the value of cryptocurrency.

Announcing that Tesla Motors Will Accept Bitcoin

Musk and his company, Tesla Motors, announced in February of this year that the organization was investing $1.5 billion USD into Bitcoin. The company also said that soon enough, customers would be able to pay for their brand-new Tesla cars in crypto.

The announcement sent the price of BTC skyrocketing.

Musk Appears on Saturday Night Live

Musk appeared on Saturday Night Live last month. Days before his appearance, the price of Dogecoin reached its all-time high of nearly $0.89 Canadian. Right after the appearance, the price of everyone’s favourite meme coin plummeted right back down.

Where Musk’s Opinion on Bitcoin Took a Turn

Just five days after his appearance on SNL, Tesla released a statement saying the company would put plans to accept Bitcoin in exchange for its vehicles on hold, citing the environmental concerns surrounding Bitcoin mining as the key reason.

As a result, everything that Musk and his company have done to shine a spotlight on Bitcoin and Dogecoin, and even Shiba-Inu, is crashing down. Crypto prices are reflecting that.

Tesla shares took a dip on the news and the price of Bitcoin went down 10%. It’s been a tough road to recovery for Bitcoin ever since.

Dogecoin And Shiba Inu Display Obvious Signs of a Crypto Bubble

If we’re being totally honest, Elon Musk is certainly influential in the short-term price action of Bitcoin, Dogecoin, and Shiba Inu, but he’s not the only reason for the craziness.

The reality is that Reddit users and Dogecoin lovers who want to see the price make it to one dollar probably have much more of an influence over the current price than a few tweets from Musk.

Musk can certainly drive traffic to Reddit pages, but he’s not looking over anyone’s shoulder when an investor sees Dogecoin is already up 5 to 10x from just a few months ago; yet they still decide to buy because there waiting for that one-dollar target, which is just a number that the Reddit community is throwing out there. The reality is there is no fundamental reason for the price of Dogecoin to be that high aside from the fear of missing out.

Shiba Inu is another story…

Shiba Inu Rockets into the Top 50

Shiba Inu is another meme coin designed mostly to challenge Dogecoin directly. Although it’s another joke coin, the market cap is not anything to laugh at. Shiba Inu is trading at a $4.2 billion Canadian valuation at the time of this writing.

Here’s the problem. Meme coins will make a select few early adopters rich, but they will also create a large share of bagholders who will lose in the long run. That is exactly what’s happening with Dogecoin and it will probably happen well after Shiba Inu falls out of the social media spotlight once somebody creates another similar project.

Couple this new trend with all of the above reasons and you can see exactly why the crypto market has been so choppy lately. Keep in mind that we haven’t even considered the fact that there is still so much going on with the coronavirus pandemic and the way governments are handling the printing of money and the ‘global reset’ of the economy. Choppy investing trends might be the new norm for quite a while, and not just in the crypto world.

Is Now the Best Time to Buy Bitcoin at Netcoins?

Whether or not now is the best time for you to jump in on Bitcoin, Ethereum, Dogecoin, Shiba Inu or any other cryptocurrency is a decision you have to make on your own based on your financial situation and your willingness to take on risk.

Of course, you can make a lot of money and increase your net worth by making the right decision, but it’s impossible to know what the future holds and you could also end up a bag holder.

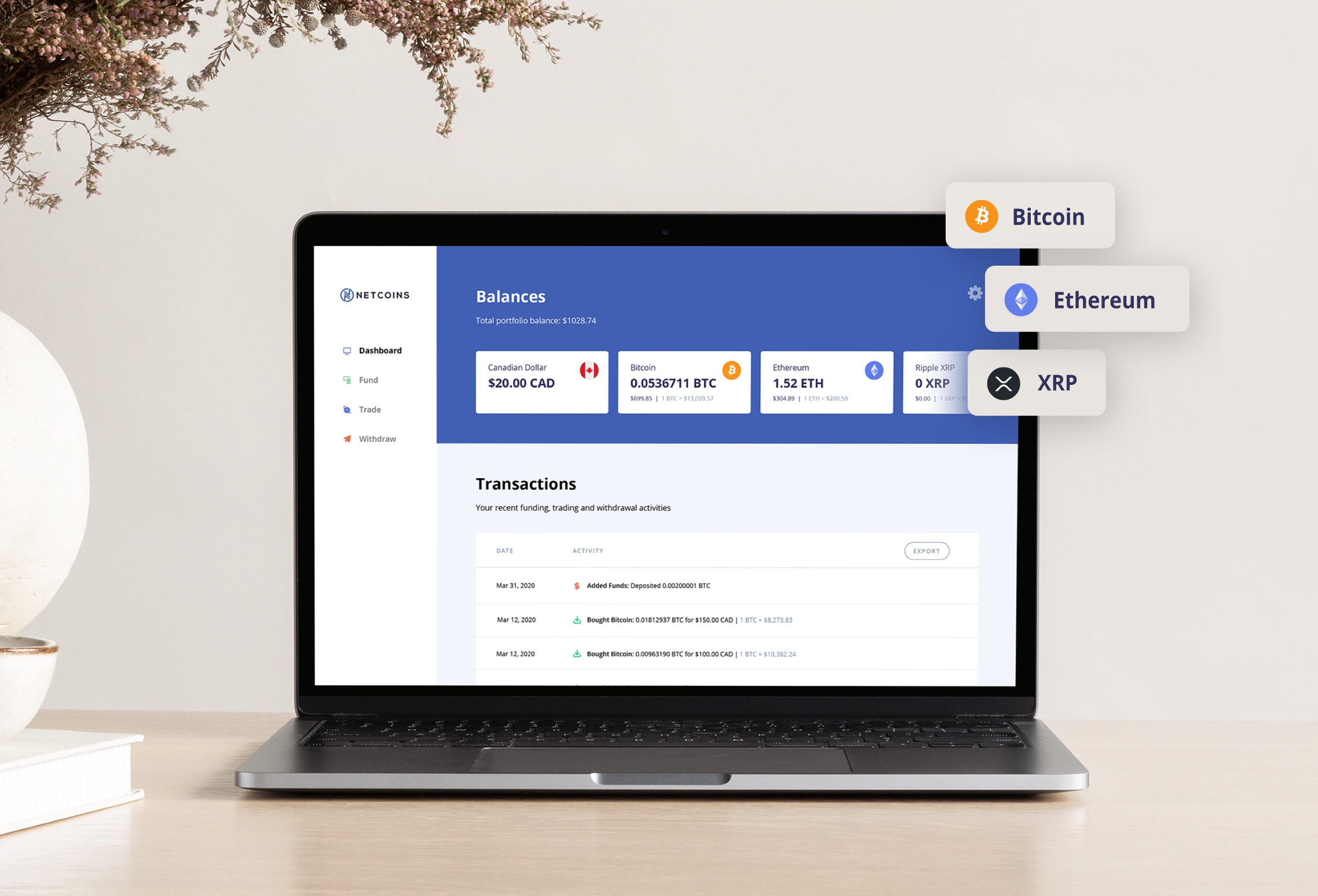

Either way, the good news is that when you do decide to invest in cryptocurrencies with Netcoins, you’re going to get the best available market rates in Canada.

Netcoins runs out of Vancouver, British Columbia, and is one of the most trusted crypto exchanges in the country.

Register for a free account today. That way whenever you’re ready to continue your crypto journey, you can do it safely and at the best prices possible.

Looking to get started with bitcoin? Netcoins makes it easy for people to buy and sell cryptocurrencies like bitcoin.

Written by: Jack Choros

Writer, content marketing at Netcoins.