How To Buy Ripple In Canada

Jack Choros

Content Marketing

Serious cryptocurrency investors looking to hedge their bets within the cryptocurrency world would be well served to learn how to buy Ripple in Canada. In this post, you’ll learn several reasons why. Judging Ripple by its market capitalization, investors ready to move beyond Bitcoin can’t help but take notice, because the project routinely floats around in the top five as one of the most valuable altcoins on the planet.

It is however a cryptocurrency with a twist. Despite its standing as one of the very best, many Bitcoin purists actually don’t like Ripple. It’s not just one of the most valuable projects on the market. It’s also one of the most controversial. That’s because Ripple isn’t truly decentralized.

The cryptocurrency that drives the Ripple blockchain, the XRP token, is built on a decentralized platform. However, the name Ripple itself alludes to the name of a private corporation. The overwhelming majority of the thousands of other crypto projects trading on exchanges are actually governed by non-profit organizations.

The mandate for a non-profit organization is program delivery, which in this case means improving the blockchain and spreading the adoption of cryptocurrency. Ripple’s mandate is to profit, and because the organization’s structure lives under a private business license, many purists argue that it’s not truly a decentralized project. That’s not just the case because of the organization behind it, it’s also the case because there are parts of the Ripple blockchain that only the private corporation can control. Although it is safe to own Ripple’s XRP token, its blockchain is not fully permissionless in the sense that certain aspects of it are controlled only by the corporation and not by a community of developers necessarily.

Nevertheless, some investors view Ripple as a perfect happy medium between investing in riskier projects that don’t have a true leader (because a community of programmers decides what happens next) and a project that at least in part functions like a proper company.

Whatever your own personal opinion is on whether or not Ripple is good or bad for the advancement of cryptocurrencies at large, gaining a greater understanding of the project’s fundamentals and who the Ripple platform is designed to serve will help you in deciding whether or not the XRP token and the company that backs it is a worthwhile investment for the sake of turning a profit.

It’s time to take a look at one of the more advanced, highly valued and controversial projects in the world of digital currencies. It’s time to get introduced to Ripple!

Who created Ripple?

Unlike the Bitcoin network and its corresponding whitepaper, which is authored by an anonymous person or group of individuals named Satoshi Nakamoto, Ripple is headed by an easily identifiable individual named Chris Larsen. Even crypto veterans don’t necessarily know who he is or what he looks like, but it’s actually pretty easy to find out. All you have to do is Google search Forbes’ list of the richest people in cryptocurrency. It was published in 2018 and the first person listed among that group is Mr. Larsen. Estimates mark his net worth at between 7.5 and $8 billion in the Forbes article, but given the overall market of cryptocurrencies has dipped since 2018, the current estimate is actually closer to $4.6 billion.

Larsen is rarely if ever interviewed openly by media outlets, but he’s an influential person in Silicon Valley and has invested in many successful startups prior to founding Ripple. Most crypto investors confuse him with the more public face of the Ripple project. That’s CEO Brad Garlinghouse. Garlinghouse is no doubt well-known crypto influencer too given that he holds the top position at Ripple, but he’s not credited as one of the founders of the project.

What is Ripple?

Ripple is the private company behind the XRP token. While the platform itself is a blockchain, it’s only partly decentralized. Ripple is what you get when a private company builds a blockchain but requires public funding in order to get things going. Most other blockchains follow the same model except that the goal is to serve the public and improve on the scalability and technicalities of the blockchain. That’s why 99% of projects are backed not only by the holders of the cryptocurrency itself, but also by non-profit umbrellas.

On the surface, Ripple and the XRP token may seem like just another decentralized currency focused on increasing adoption and allowing individuals to take control of their own money outside of the watchful eyes of a government or centralized authority. It’s certainly not that.

Private corporations are always in the business of turning a profit. In publicly focused blockchains, the profiteers are large-scale mining companies and individuals who choose to buy and sell cryptocurrencies.

The people that run Ripple therefore represent a for-profit venture, and the Ripple platform itself is not interested in aiding the financial freedom of the individual. Ripple’s mandate is to work with central banks and make processing and transferring large volumes of money between those banks cheaper and faster in a way that traditional centralized ledger technology can’t do.

The value of the XRP token goes up because central banks doing business together on the Ripple blockchain need to spend tokens in order to complete transfers. Those tokens are burned once they are used, so the supply of XRP tokens decreases over time and increases the value of the remaining tokens.

Looking to buy XRP in Canada? Read here to get started.

Four Key Benefits Of Using Ripple

Ripple is arguably the most polarizing project of all the cryptocurrencies available for buying and selling on the open market today. Those that do choose to invest in XRP tokens typically do so for the reasons listed below:

Privately Owned: The fact Ripple is a privately held company means it’s a for-profit business. Stakeholders have a built-in incentive to make the value of the XRP token go up. This means that everybody wins. It also means that the executive team running the company behind the project is at least partly focused on increasing shareholder value in order to line their own pockets too.

Serving Central Banks: Outside of using stablecoins to hedge against the broader volatility of the crypto market without having to turn digital currency back into Canadian dollars, Ripple offers a unique way for investors to get exposed to the blockchain and digital currencies without completely leaving the traditionally centralized world of finance. Ripple facilitates large-volume transactions for central banks across the world. If the project succeeds long-term, token holders get a cut of that value.

Liquidity: Ripple’s blockchain sees billions of dollars in volume trading hands each day. That means investors looking to execute trades generally don’t have to worry about a buyer or seller being available on the other side of the transaction as long as the desired price is met. High volumes of liquidity makes it easier to enter and exit positions involving XRP tokens in comparison to lesser-known altcoins that trade at much lower volumes.

Cheaper Price: buying a full Bitcoin costs thousands of dollars. Full XRP tokens can be had for mere pennies. This means investors can enjoy the feeling of owning an entire token (or many of them) rather than just a fraction of one.

How to Buy XRP In Canada

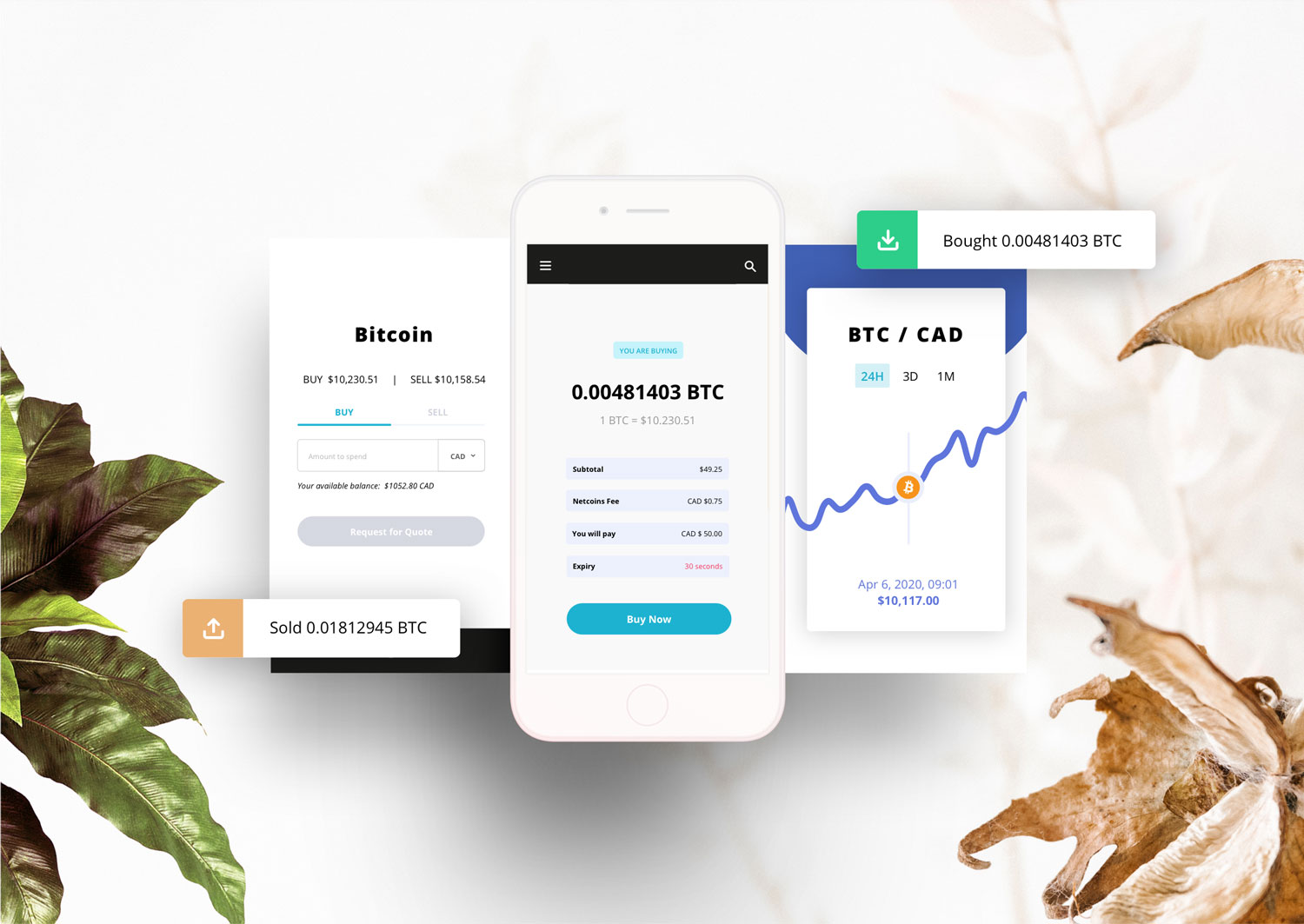

Buying XRP with Netcoins means supporting a Canadian cryptocurrency exchange in Vancouver. Netcoins serves users all across the country with a wide variety of deposit options that make it convenient to turn Canadian dollars into digital currency in a flash. Opening an account is free and the entire process can be completed through these four easy steps.

Looking to buy XRP in Canada? Read here to get started.

Step 1: Register a Username and Password

Pick a username and password unique to you. It’s free and all you need is a valid email address to get started. Once you confirm your email address, you can proceed with verifying your account.

Step 2: Verify Your Netcoins Account

Verifying your identity with government issued ID is as easy as uploading a valid driver’s license or Canadian passport. Doing this online is fast, convenient and totally secure.

Step 3: Funding Your Netcoins Account To Buy Ripple

Funding a Netcoins account can be done using an e-transfer, online bill payment or bank wire transfer. Users can also deposit existing digital currencies onto the Netcoins platform and start trading as soon as the transaction is confirmed on the blockchain. Your financial institution may charge you a fee if you use a bank wire transfer, but Netcoins doesn’t charge anything to receive a deposit from you. Get started instantly with an e-transfer even if you don’t already own crypto, or deposit larger amounts for free by registering Netcoins as a bill payment with your bank. It takes 3 to 5 business days for bill payments to go through, then you’re off to the races.

Step 4: Buy Ripple XRP Tokens

Remember, buying your way into Ripple means acquiring the XRP token.

Netcoins allows you to do so through all of the classic order types offered by major trading exchanges. Happy with acquiring tokens at the current price? No problem! Simply set up a market order and pay fair market value for your tokens. Looking to acquire your XRP tokens at a specific price? Also easy. Just set up a limit order. Your order only triggers if you get your tokens at the price you want.

Since Ripple’s daily trading volume ranks among the top projects in cryptocurrency, executing orders is as easy as trading the BTC/XRP trading pair at Netcoins. No need to bother switching to an altcoin or stablecoin first!

It’s time to set up an account on Netcoins and benefit from the hundreds of millions of dollars central banks trade every single day. All just by owning some Ripple.

Written by: Jack Choros

Writer, content marketing at Netcoins.