Is COVID-19 Bringing More Canadians to Bitcoin?

Ayelen Osorio

Community + Content Marketing

As the world continues to live in isolation in a global effort to flatten the curve and slow the spread of COVID-19, it’s becoming quite clear that more and more people are putting their faith in Bitcoin and digital currencies over the stability of big banks. The fact that the virus is gripping hold of the world and protests surrounding human rights and police brutality are currently the order of the day, people’s trust in digital money is actually accelerating.

Understanding where the trend started, why it’s continuing to excel, and why it matters to Canadians and everybody that believes in blockchain technology and the future of peer-to-peer payment systems is paramount to understanding what’s about to happen and how virtual currencies and the blockchain are going to catapult the human race to a new era. A revolution where everybody controls their own data and their own value, and only the permission of the individuals involved in the transaction is required for that value and data to exchange hands.

Investing in Bitcoin is on the Rise

A recent study published by a cryptocurrency think tank called The Tokenist suggests that the faith people have in traditional major banks and other aspects of the fiat financial system is steadily decreasing. Nearly 5500 participants and 24 different countries are part of the study which includes surveys dating back to 2017.

As the study points out, Bitcoin’s introduction to the world will always be tied to the 2008 Global Economic Crisis. The whitepaper detailing the project was published in and around that time, a time when the masses were looking for answers as some of the largest financial institutions in North America began to collapse under the weight of credit default swaps and subprime mortgages.

A separate study featuring nearly 5,000 participants in 17 countries, including Canada, suggests that more and more individuals are developing a definitively strong positive sentiment towards the idea that Bitcoin is a good long-term store of value.

47% of people who answered the surveys this year say they trust Bitcoin over major banks, which represents a 29% increase in positive response as compared to the same survey taken three years ago.

Are Canadians Flocking to Bitcoin Right Now?

Nearly a million Canadians applied for the Canadian Emergency Response Benefit program on the first day applications open to the public. The program provides Canadians struggling with work due to the coronavirus pandemic with $2,000 in monthly assistance from the government for a four-month period. So are more and more Canadians flocking to Bitcoin given that they have access to that money now? The answer to that question is likely reflective of what Americans are doing with funds they are receiving from similar programs south of the border.

Coinbase CEO Brian Armstrong recently tweeted that a very high number of crypto purchases on his exchange totalled exactly $1,200. The total number of deposits worth that exact amount were up by more than 400% in April in comparison to the normal volume that the exchange sees during any other time of the year. This clearly means a significant percentage of Americans are willing to gamble on Bitcoin even at a time when many small business owners need those funds to pay for other things. The reality is at least some investors who may have a little bit of money saved up for a rainy day and may not be in immediate need of the $1,200 stimulus check are obviously willing to take a risk in the short term to see if they can profit in the long run.

Relaxed CERB Rules Are Making It Easy to Choose Bitcoin… Sort Of

With Prime Minister Justin Trudeau scrambling to find innovative ways to take care of Canadians, just like other world leaders are doing for their countries, the CERB fund saw Canadians receiving money in April. The government stated that Canadians working in any facet of the economy could apply for the money and receive a total of $8,000 over four months. While the application guidelines do stipulate that the money is intended for people experiencing financial hardship as a result of a loss of work, the government’s infrastructure isn’t necessarily prepared to handle millions of applications all at once.

In response to trying to fix that problem, Canada guarantees that anybody who applies for CERB funding will get the money regardless of whether or not they are eligible. Anybody deemed not eligible to receive the funds because they can’t prove significant financial hardship will be forced to repay the CERB money in the form of a loan. Suffice it to say that when Canadian taxpayers are filing their income tax for 2020, things are really going to get complicated and many Canadians are going to find themselves owing more than they expected.

That said, if one bird in the hand is worth two in the bush, people looking to use CERB to bet on Bitcoin can do that right now and worry about the repercussions later, if they dare.

How the Canadian Government May Be Inadvertently Curbing Bitcoin Enthusiasm

For those reading this hoping to throw $8,000 into Bitcoin, Ethereum or any number of other digital currencies in an effort to try to increase their net worth, proceed with caution.

Canada Revenue Agency is currently collecting $190,000 worth of CERB benefits Canadians shouldn’t be claiming. More of this will be happening as the months go on, especially as our country moves towards the fall. Why is that? It’s because Canadian banks offering citizens breaks on their mortgages and interest rates for a six month period are going to expect to collect their money once the leaves outside start changing colour again. It’s at that point our country will find out how many of us can afford to keep our heads above water in a post-coronavirus Canada.

There’s also one more major policy change to consider. That’s the fact that Canadians found filing fraudulent claims for CERB benefits they don’t need can be fined $5,000 and face jail time. Some experts are suggesting that this could actually deter people who really need the money from applying in the first place.

Either way anybody who wants to buy a Bitcoin in Canada using CERB funds, or money out of their own wallets for that matter, needs to consider that there is always a risk with investing money, and that investing borrowed funds or funds that may need to be paid back to the government at some point is an even bigger risk. Only buy Bitcoin and other digital currencies from a trusted crypto exchange in Canada, like Netcoins.

Why Canadians Will Continue to Store Wealth in Bitcoin

Although the long-term public health and financial fallout of the coronavirus pandemic in Canada is still yet to be fully realized, the reality is Canadians will continue to store their wealth in Bitcoin in the near and distant future, and the Bitcoin bandwagon will likely continue to grow in this country as time goes on.

The fact that the Canadian government is continuing to regulate Bitcoin-related companies in a clearly defined manner and continuing to show genuine concern for protecting the wealth and safety of Canadian crypto businesses and Canadian crypto enthusiasts only means that the ability to buy a Bitcoin in Canada should get easier and easier in the Great White North as time goes on.

If this pandemic is teaching Canadians anything about how our society views Bitcoin and digital currencies, it’s that whatever Bitcoin’s next frontier is, Canada is undoubtedly going to play a big role in pushing the adoption of Bitcoin and cryptocurrencies forward.

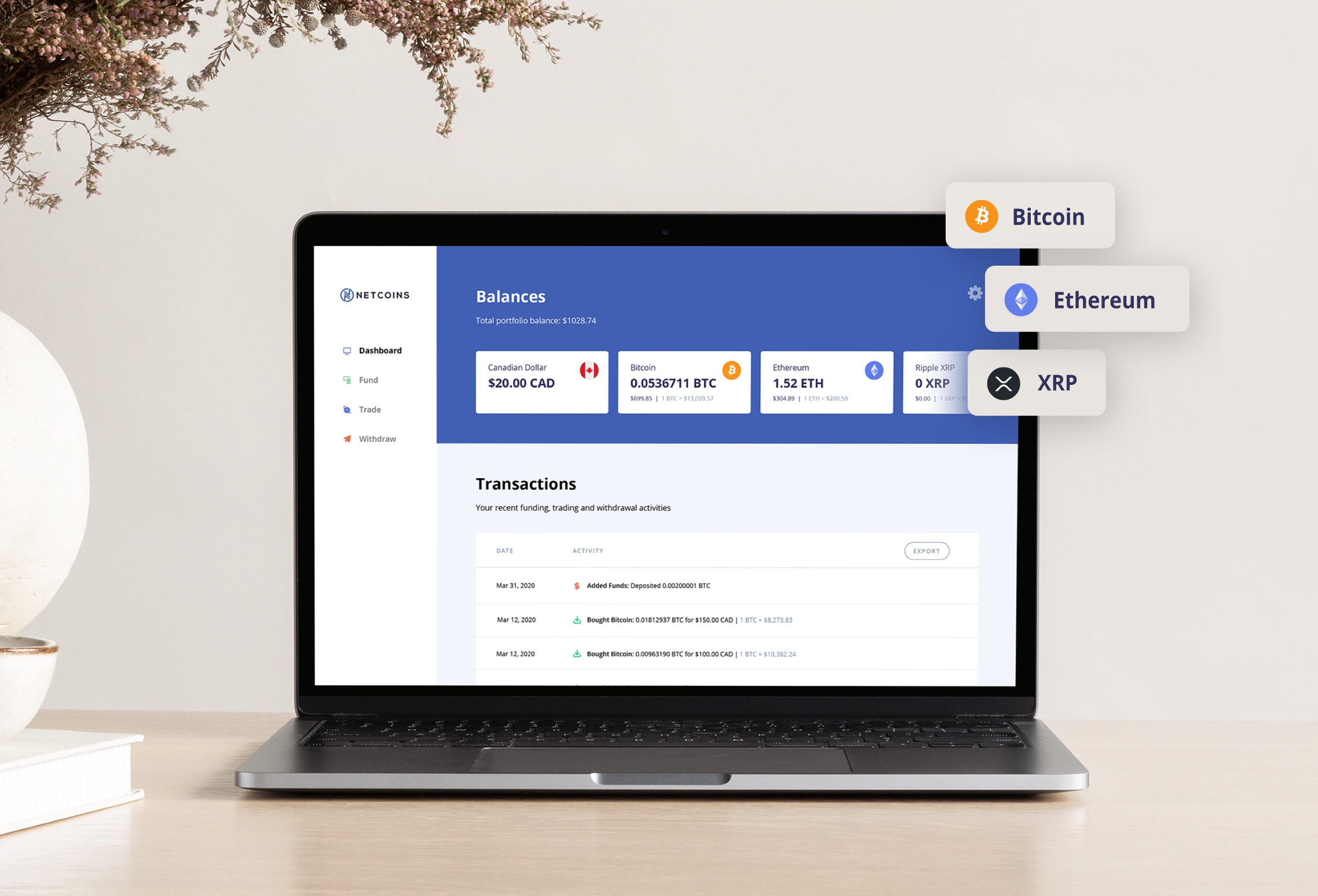

If you’re looking to purchase Bitcoin or other cryptocurrencies, buy Bitcoin with Netcoins. Create an account, fund it with an e-Transfer (other funding options available), and head to the trade page to buy or sell bitcoin. Netcoins is a fully regulated, publicly owned crypto trading platform.

Written by: Jack Choros

Writer, content marketing at Netcoins.