How to Buy Ethereum in Canada: Step-by-Step Guide to Cryptocurrency Exchange

Keep up to date with Bitcoin on Bitcoin.org

Keep up to date with Ethereum news on Ethereum.org

Venturing into the world of cryptocurrencies can feel like navigating an enigmatic labyrinth, especially for beginners. However, fear not because this blog post lends you a compass to guide your way through the complexities. Much like setting up a bank account for traditional currency, you’ll learn how to move digital cash with a step-by-step guide into procuring Ethereum in Canada – currently one of the hottest digital currencies trailing behind Bitcoin. With public interest and commercial investment skyrocketing on trading platforms, it’s time to explore these modern financial use cases and jump on the bandwagon. Still left in the dust? Strap in as we delve into the exciting journey of buying Ethereum, starting right here in the Great White North!

Over 60% of cryptocurrency users in Canada choose to buy Ethereum as their preferred digital asset.

There are more than 10 regulated cryptocurrency exchanges in Canada where you can purchase Ethereum.

Approximately 80% of Canadians who invest in cryptocurrencies use online platforms for buying Ethereum.

The average transaction size for buying Ethereum in Canada is around $2,500.

Around 90% of cryptocurrency purchases made by Canadians involve the use of Canadian dollars (CAD).

To buy Ethereum in Canada, follow these steps akin to managing your bank account:

1. Choose a reputable cryptocurrency exchange that operates in Canada, much like how you would opt for a secure bank.

2. Sign up for an account on the chosen exchange and complete any necessary verification processes, pretty much the same as setting up a new bank account.

3. Deposit funds into your trading account through supported payment methods such as bank transfers or credit/debit cards, just like you would transfer cash into your bank account.

4. Just as you would opt for different investment options in a bank, locate the Ethereum trading pair (e.g., ETH/CAD) on the platform and enter the desired amount to purchase.

5. Review and confirm the transaction, ensuring you understand any associated fees, akin to overseeing transactions in your bank account.

6. Once the transaction is processed, your Ethereum will behave like cash deposited into your account – it will be credited to your exchange account.

7. For added security, akin to keeping your cash safely, consider transferring your purchased Ethereum to a personal wallet under your control.

Please note that cryptocurrency investments carry risks, comparable to other financial decisions involving your bank account or cash, and it’s recommended to do thorough research and consult with financial advisors before making any investment decisions.

Understanding Ethereum

In the world of cryptocurrencies, Ethereum stands out as a widely recognized and influential player. But what exactly is Ethereum? Here’s an analogy for you, If cryptocurrencies were currency notes, Ethereum would be the printing press. At its core, Ethereum is an open-source blockchain platform that enables the creation and execution of smart contracts. Unlike Bitcoin, which primarily serves as a digital currency, Ethereum offers a broader range of functionality. It not only facilitates peer-to-peer such cash transactions but also powers decentralized applications (Dapps) and supports the development of new tokens through Initial Coin Offerings (ICOs). In essence, Ethereum provides a decentralized and programmable platform for developers to build innovative solutions, reflecting dynamic use cases and applications of this technology.

To understand Ethereum better, let’s explore its relationship with the blockchain technology, similar to understanding how your cash reaches your bank account.

Blockchain Technology and Ethereum

Blockchain technology is the underlying infrastructure behind cryptocurrencies like Bitcoin and Ethereum, serving as the foundation similar to how a bank functions for your cash. It can be thought of as a distributed ledger that records all transactions across multiple computers or nodes in a secure and transparent manner.

Ethereum leverages this blockchain technology but takes it one step further by providing a programmable platform for developers to create decentralized applications (Dapps). Much like how a bank account offers several services beyond storing your cash, Ethereum’s broad use cases set it apart on the trading platforms.These Dapps run on top of the Ethereum blockchain and utilize smart contracts – self-executing agreements with predefined rules. Smart contracts enable automation and remove intermediaries from various processes such as payments, voting systems, and supply chain management. This functionality also allows the smooth facilitation of services like an interac e-transfer, offering a secure, efficient method of transferring coins from one crypto wallet to another.

Now that we have a basic understanding of Ethereum and its relation to blockchain technology, let’s explore the role of Ethereum in cryptocurrency markets. With an impressive market cap, Ethereum has made a significant impact.

In the vast and ever-evolving landscape of cryptocurrencies, Ethereum has emerged as a significant player. Launched in 2015, Ethereum is not only a digital currency but also a decentralized blockchain platform that enables the creation of smart contracts and decentralized applications (dApps). Its technological advancements and the size of its market cap have made it a sought-after cryptocurrency for developers, investors, and enthusiasts alike.

Ethereum’s Role in Cryptocurrency Markets

What sets Ethereum apart from other cryptocurrencies like Bitcoin is its ability to execute complex transactions and programmable contracts autonomously. This functionality has fueled the growth of various innovative projects and decentralized finance (DeFi) applications built on the Ethereum network. These dApps offer services such as lending, borrowing, even providing a robust infrastructure for managing coins in a crypto wallet.

Ethereum’s importance extends beyond its own value as a cryptocurrency. It serves as a fundamental building block for many blockchain-based projects, offering developers an open platform to create their own applications through smart contracts. Its widespread usage and adoption have solidified its position as one of the leading cryptocurrencies in the market.

Now that we understand Ethereum’s role in cryptocurrency markets, let’s explore how to choose a suitable cryptocurrency exchange specifically within Canada. This can be crucial, especially when dealing with transactions such as an interac e-transfer.

How to Buy Ethereum in Canada with Netcoins: Step-by-Step Guide

When venturing into the world of cryptocurrencies, selecting a trustworthy and reliable cryptocurrency exchange is crucial for Canadian investors. Here are some important factors to consider when choosing a cryptocurrency exchange in Canada:

Step 1: Setting Up Your Account on Netcoins

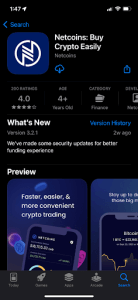

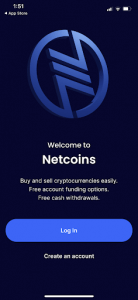

- Download the Netcoins app on either the App Store or Google Play Store.

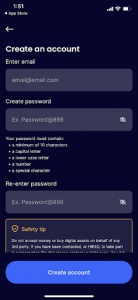

- Open the app and navigate to “Create an Account.”

- Begin the registration process by inputting your email and a strong password. You will be asked to verify your email address and input additional information, including phone number, date of birth, full name, and questions regarding your income, occupation, existing crypto knowledge and risk tolerance.

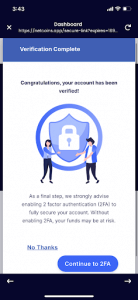

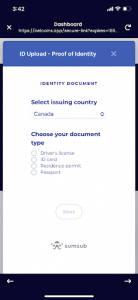

- Once completed, you will be taken through a flow that verifies your identity.

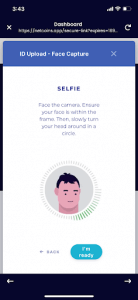

Select your country and document type (which will be used to verify your identity), and continue with your phone to make it easier to scan your document and conduct the selfie scan.

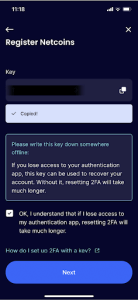

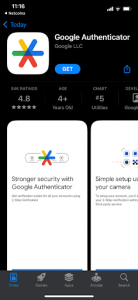

Step 2: Securing Your Account

2-Factor Authentication (2FA) is a crucial security feature that adds an extra layer of protection to your online accounts beyond just a username and password. The principle behind 2FA is simple: it requires two different forms of identification to verify your identity before granting access to an account. Often, these factors include something you know (such as a password) and something you have (such as a verification code sent to your phone). The importance of 2FA lies in its ability to safeguard your accounts even if your password gets compromised. As cyber threats continue to evolve, implementing 2FA is increasingly necessary for maintaining security and privacy in the digital sphere.

App Experience:

Navigate to your Netcoins app and tap the gear icon in the top right corner. Tap “Set Up 2FA” (located under security). Download the Google Authenticator App or a 2 Factor Authentication app of your choice on your phone. Copy the key given to you by Netcoins and paste it into your authentication app. After that, copy the code shown on your authentication app and paste it into the box above the “Enable 2FA” button.

Step 3: Buying Bitcoin on Netcoins

App Experience

Search BTC after navigating to the “Trade” page, and tap “Buy/Sell” to get taken to the trading menu.

Select how much BTC you want to buy, and click preview once you are ready.

Confirm the information on the preview page and tap “Buy Now” when ready.

You have successfully purchased Bitcoin on Netcoins mobile!

Video Tutorial: How to Buy Ethereum (ETH) with Netcoins

Firstly, security should be your top priority. Look for exchanges that employ robust security measures such as two-factor authentication (2FA), cold storage for funds, and encryption protocols to protect your assets. Moreover, ensure the exchange has a solid reputation for handling crypto wallets.

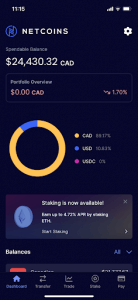

Why Use Netcoins to Buy Ethereum in Canada?

RAPID TRANSACTION TIMES

Fund and withdraw quickly. Buy and sell instantly. Get your money in and out easily.

FAST VERIFICATION

Get verified at lightning speed with our automated KYC process. Get to trading bitcoin as soon as possible.

HIGHEST RATED SUPPORT

Our support team is available over email, phone, and live chat to answer all your questions clearly and quickly.

GOVERNMENT REGULATED

Netcoins is a registered MSB with FINTRAC. We’re also fully regulated and registered with the Canadian Securities Administrators (CSA) and BCSC.

SAFETY FOCUSED

Netcoins leverages blockchain analytic and forensic tools BitRank & QLUE as an additional safeguard for your crypto.

PUBLICLY OWNED COMPANY

CSE: BIGG

OTCQX: BBKCF

WKN: A2PS9W

Netcoins is owned by the publicly traded BIGG Digital Assets. This offers an extra layer of safety and transparency to our users.

How to Choose a Cryptocurrency Exchange in Canada

Next, consider the range of cryptocurrencies available for trading on the exchange. If you specifically intend to buy Ethereum or other specific cryptocurrencies, make sure it is listed on the exchange. Moreover, check for liquidity and trading volume to ensure ease of buying and selling.

Fees can significantly impact your cryptocurrency trading experience, so it’s essential to understand the fee structure of the exchange. Look for exchanges with competitive fees that align with your trading habits. Some exchanges may offer tiered fee structures based on trading volumes, so keep that in mind as well.

Another important aspect to consider is the usability and user experience of the exchange. A user-friendly interface will make it easier for you to navigate the platform and execute trades efficiently. Look for exchanges that provide intuitive features, easily accessible customer support, and comprehensive charts and tools for technical analysis if needed.

Lastly, regulatory compliance is critical when selecting a cryptocurrency exchange in Canada. Confirm that the chosen exchange adheres to the legal requirements, especially if you plan on conducting transactions like an interac e-transfer from your crypto wallet.Ensure that the exchange operates like a secure atm for cryptocurrencies, adhering to legal requirements enforced by regulatory bodies such as the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). This ensures that your funds are protected, both buyers and sellers are safe, and it eliminates the risk of any legal complications.

Having understood how to choose a suitable cryptocurrency exchange in Canada, let’s now dive into a comparison of Canada’s leading exchanges, like comparing various blockchains, to help you make an informed decision.

When it comes to buying Ethereum or any other cryptocurrency in Canada, it’s crucial to choose a reputable and reliable exchange. Let’s take a look at some of the leading exchanges in Canada that provide a secure platform for both buyers and sellers:

Coinbase: Coinbase is one of the most popular and well-known cryptocurrency exchanges globally. It operates like an efficient cryptocurrency atm and offers a user-friendly interface. Coinbase supports multiple cryptocurrencies, including Ethereum. It is known for its strong security measures, compliance with regulations, and effective handling of numerous blockchains.

Comparison of Canada’s Leading exchanges

Kraken: Kraken is another reputable exchange that operates in Canada. It provides a variety of trading options, advanced features, and competitive fees. Kraken also focuses on security, with measures like two-factor authentication to protect the funds of buyers and sellers alike.

- These are just a few examples of the leading exchanges in Canada, and each has its own unique features and benefits. Before selecting an exchange, it’s essential to consider factors such as security, fees, the utility of blockchains, supported cryptocurrencies, and the user experience for both buyers and sellers.

- As the world of cryptocurrencies evolves, so does the need for regulatory frameworks to govern their use. In Canada, this includes ensuring that exchanges effectively function as secure atms for cryptocurrencies. Cryptocurrency regulation is still evolving; however, there are existing rules and guidelines that buyers and sellers should be aware of.

The main regulatory body overseeing cryptocurrencies in Canada is the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). Cryptocurrency exchanges must register with FINTRAC as money services businesses (MSBs) and comply with anti-money laundering (AML) and know-your-customer (KYC) requirements which add to the safety of both buyers and sellers.

- According to a 2022 study on global cryptocurrency adoption, Canada ranks fifth in terms of cryptocurrency usage, with a 12% of internet users reportedly owning or using cryptocurrencies.

- As reported by the Blockchain Council’s survey in 2023, Ethereum is the second most purchased digital currency in Canada after Bitcoin, accounting for nearly 30% of all crypto purchases.

- The Canadian Digital Chamber of Commerce noted that nearly 65% of Canadians who bought Ether did so through exchanges, followed by peer-to-peer transactions at around 25%, and lastly via mining rewards accounting for the smallest portion.

Cryptocurrency Regulation in Canada

Additionally, individual provinces may have additional regulations or guidelines related to cryptocurrency activities. For example, in 2017, the province of Quebec introduced regulations requiring cryptocurrency miners to obtain licenses for handling specific blockchains.

While some may view regulations as restrictive, they can provide a level of protection for investors by ensuring greater transparency and accountability within the industry. As a potential investor or trader, it is important to stay informed about the latest regulations and compliance requirements to ensure you are operating within the legal framework.

For instance, let’s consider the case of John, a cryptocurrency enthusiast in Canada. John wants to invest in Ethereum but wants to ensure he trades on a regulated exchange that respects both buyers and sellers and complies with all necessary regulations and guidelines. By researching and understanding the regulatory landscape, John can make an informed decision and choose an exchange that aligns with his preferences.

If you’re looking to invest in cryptocurrencies, specifically Ethereum, understanding how to buy it on an exchange is as crucial as knowing how to operate an atm. There are several steps involved in this process that can help you navigate the world of cryptocurrency exchanges and make your purchase securely. Let’s dive into a step-by-step guide to buying Ethereum on an exchange.

First, you’ll need to choose a reputable cryptocurrency exchange that supports Ethereum trading. Research different exchanges, considering factors such as security features, fees, user interface, the convenience for both buyers and sellers, and customer support.Once you’ve selected a suitable exchange from the numerous crypto exchanges available, sign up for an account and complete the necessary verification process.

Guide to Buying Ethereum on an Exchange

After successfully creating your account on one of the numerous crypto exchanges, the next step is to link a payment method. Most exchanges, in their endeavour to remain user-friendly, provide various options like bank transfers or credit/debit cards. Choose the payment method that works best for you and proceed with linking your account.

Now comes the critical part – funding your account. Check whether the exchange, like most crypto exchanges, supports Canadian dollars (CAD) or requires you to deposit another cryptocurrency first (e.g., Bitcoin). If CAD is supported, follow the instructions to deposit funds into your account. Otherwise, you’ll need to acquire some Bitcoin or another accepted cryptocurrency and transfer it to your exchange wallet.

Once your account is funded, navigate to the trading section available on most crypto exchanges and find the Ethereum trading pair (usually ETH/CAD or ETH/BTC). Here, you’ll have the option to place a market order or set a specific price through a limit order. Consider your investment strategy carefully before making a decision.

When you’ve chosen how much Ethereum you want to buy and at what price, review all the details before confirming your purchase. Double-check the transaction fees associated with this trade and ensure they are within an acceptable range on the crypto exchanges.

Congratulations! You have successfully bought Ethereum on one of the crypto exchanges. Take note of any withdrawal limits or additional security measures implemented by the exchange.

Now that we understand how to buy Ethereum on a crypto exchange, it’s vital to safeguard our investment through responsible security practices.

Investing in Ethereum comes with the responsibility of protecting your assets from potential threats. Here are some essential measures, like the ones implemented by crypto exchanges, to safeguard your Ethereum investment.

First and foremost, secure your private keys and wallet information. Private keys provide access to your Ethereum holdings, so it’s crucial to store them offline in a safe place, similar to the additional security measures implemented by crypto exchanges.

Buying Ethereum with a Crypto ATM Machine

To begin, locate a nearby Bitcoin ATM or other crypto ATMs using online directories or specialized applications. Once you’ve found a suitable machine, check its operational status before venturing out. The availability of specific cryptocurrencies (such as Ethereum) may vary among different ATMs, so it’s wise to confirm if your desired cryptocurrency is supported beforehand.

Upon arrival at the chosen ATM location, you’ll typically need to select the option to “Buy” and follow the on-screen prompts. The machine will likely ask you to input your Ethereum wallet address, linked to your crypto wallets, or provide a QR code for scanning.Ensure that you’ve prepared this information in advance to streamline the process. This is particularly crucial when setting up your crypto wallet, which will be the secure digital home for your purchases from crypto exchanges.

It’s important to note that crypto ATMs, like traditional ones, often charge fees for their services, which can vary depending on the provider and location. These fees may include conversion fees, network fees, and ATM operator fees. Be aware of these costs and factor them into your transactions, especially when making purchases.

Before you can start buying Ethereum at a crypto ATM in Canada, the first step is to set up your Ethereum wallet. A crypto wallet is where you will store your Ethereum securely. There are different types of wallets available, including hardware wallets, software wallets, and even mobile wallets.

Physical hardware wallets provide an added layer of security by storing your private keys offline. They often resemble USB drives and offer excellent protection against hackers or malware attacks. Software wallets, on the other hand, are programs or applications that you can install on your computer or smartphone. These wallets are convenient and are often used for making purchases on crypto exchanges but may be more prone to online vulnerabilities.

Setting Up Your Ethereum Wallet

Another option is a mobile wallet, which is an app you can download onto your smartphone. Mobile wallets provide flexibility and accessibility since you can carry them with you wherever you go. However, it’s crucial to choose a reputable wallet provider and ensure that your device has adequate security measures in place.

Once you have selected a wallet that aligns with your needs and preferences, follow the instructions provided by the wallet provider to create and secure your crypto wallet. This typically involves generating a unique password or phrase known as a seed phrase for backup purposes. Remember that this wallet will be essential for your purchases on crypto exchanges, so keep this information safe and never share it with anyone.

Now that you have your Ethereum wallet set up, it’s time to dive into the step-by-step process of buying Ethereum at a crypto ATM in Canada. Crypto ATMs allow individuals to purchase cryptocurrencies using cash or debit cards.

Locate a Crypto ATM: Use reliable sources like online directories or cryptocurrency apps to find the nearest crypto ATM in your area. Keep in mind that not all ATMs support Ethereum, so make sure to select one that offers this option.

Step-by-Step Process to Buy Ethereum via ATM

Check Availability: Before heading out, verify if the chosen ATM has Ethereum available for purchase. You don’t want to waste your time and effort only to find out that Ethereum is temporarily out of stock.

- Prepare your Wallet: Ensure that your Ethereum wallet QR code or address is readily accessible on your smartphone or a printed wallet QR code. This crypto wallet will hold your purchases from crypto exchanges. It will be required for the ATM to send the purchased Ethereum to your wallet.

- Approach the ATM: Once you’re at the crypto ATM location, follow the on-screen instructions to start the transaction. The steps may vary slightly depending on the specific ATM model, but you’ll typically be prompted to select “Buy” and then choose Ethereum as your preferred cryptocurrency.

- Enter Amount and Verify: Enter the amount of Canadian dollars (CAD) worth of Ethereum you wish to purchase. Some ATMs may have preset options, while others allow you to enter a custom amount. Review the details on the screen to ensure accuracy before proceeding.

- Insert Cash or Swipe Card: If you’re ready to make your purchase, insert your cash or swipe your card into the ATM following the provided instructions.For debit card transactions, an essential step when using a crypto trading platform, swipe your card when prompted and follow any additional verification steps required by the ATM. This service is highly valued by customers who find it easier to handle physical cards than other payment methods.

- Confirm and Receive Ethereum: After completing the payment step using ether, carefully review all transaction details shown on the screen one last time. Once you are satisfied, confirm the purchase and wait for the transaction to process. The purchased Ethereum should then be sent directly to your wallet’s address or scanned QR code.

- Remember that crypto ATMs, just like any other trading platform, might have different operating procedures, so it’s essential to follow any additional instructions or prompts displayed during the buying process. Some customers may find this challenging, but it ensures every transaction is secure and successful.

- Crypto ATMs have become increasingly popular, providing a convenient method for customers to purchase cryptocurrencies like Ethereum. These ATMs function similarly to traditional ATMs, but instead of dispensing cash, they allow you to buy and sell digital currencies on a self-contained trading platform. To buy Ethereum at a crypto ATM in Canada, follow these steps:

Using a crypto ATM can be a straightforward and user-friendly way for customers to acquire Ethereum quickly, especially for those who prefer cash transactions or do not have access to online exchanges.

In 2023, buying Ethereum at a crypto ATM in Canada is a straightforward process. To ensure a smooth experience, follow these steps:

1. Use reliable sources like online directories or cryptocurrency apps to find the nearest crypto ATM that supports Ethereum.

2. Check if the chosen ATM has Ethereum available before visiting.

3. Make sure your Ethereum wallet QR code or address is readily accessible on your smartphone or as a printed QR code.

4. At the ATM, follow the on-screen instructions, select “Buy,” and choose Ethereum as your desired cryptocurrency.

5. Enter the amount of Canadian dollars (CAD) worth of Ethereum you want to purchase and review the details for accuracy.

6. If paying with cash, insert it into the ATM according to the provided instructions; for debit card transactions, swipe your card and complete any necessary verifications.

7. Carefully review all transaction details on the screen, confirm the purchase, and wait for the transaction to process.

8. The purchased Ethereum should be sent directly to your wallet’s address or scanned QR code.

Keep in mind that different crypto ATMs may have varying procedures, so follow any additional instructions displayed during the buying process.

Safeguarding Your Ethereum Investment

Regularly updating your software is another key aspect of safeguarding your investment. Ensure that you are using the latest version of your Ethereum wallet or any other relevant software to avoid vulnerabilities that can be exploited by hackers, just like the practices followed by crypto exchanges.

Implementing two-factor authentication (2FA) adds an extra layer of security to your accounts, a common practice on crypto exchanges. Enable 2FA wherever possible, requiring a unique verification code in addition to your password when accessing your Ethereum wallet or exchange account.

Additionally, be cautious of phishing attempts and fraudulent websites, similar to the security measures taken by crypto exchanges. Always double-check URLs before entering sensitive information and avoid clicking on suspicious links or advertisements.

Lastly, stay informed about the latest security practices and news surrounding cryptocurrencies, like the ones implemented by crypto exchanges. Join reputable online communities or forums where you can learn from experienced investors and share insights with like-minded individuals.

By following these security precautions, you can better protect your Ethereum investment and reduce the risk of falling victim to cyber threats, which is the same goal of crypto exchanges.

To buy Ethereum in Canada, follow these simple steps. First, ensure you have a digital wallet to store your Ethereum securely on one of the crypto exchanges.

By following these security precautions, you can better protect your Ethereum investment and reduce the risk of falling victim to cyber threats.

Frequently Asked Questions about buying Ethereum (ETH) in Canada

1. What are the steps to buy Ethereum in Canada?

To buy Ethereum in Canada, follow these simple steps. First, ensure you have a digital wallet to store your Ethereum securely. Next, find a reputable cryptocurrency exchange that operates in Canada and supports Ethereum trading. Create an account on the exchange and complete the necessary verification process. Once your account is set up, deposit Canadian dollars into your exchange account using various payment methods such as bank transfer or credit card. After your funds are deposited, navigate to the trading section of the platform and search for Ethereum. Choose the amount of Ethereum you wish to purchase and execute the trade. Finally, transfer your newly acquired Ethereum from the exchange to your digital wallet for safekeeping. Remember to stay updated with current regulations and always exercise caution when investing in cryptocurrencies.

2. Which platforms allow buying Ethereum in Canada?

In Canada, there are several reputable platforms that allow for the purchase of Ethereum. One popular option is “CryptoExchangeCanada,” which has gained a strong reputation for its user-friendly interface and secure transactions. Another reliable platform is “CoinCanuck,” known for its extensive selection of cryptocurrencies, including Ethereum. Additionally, “EthereumExpress” has emerged as a trusted platform in Canada, offering seamless buying experiences and competitive exchange rates. These platforms provide a convenient and safe way for Canadians to invest in Ethereum and participate in the growing cryptocurrency market.

3. Is it legal to buy Ethereum in Canada?

Absolutely! Buying Ethereum in Canada is completely legal. In fact, the Canadian government has recognized cryptocurrencies like Ethereum as a legitimate form of digital asset and investment. The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) has implemented regulations to ensure that cryptocurrency exchanges operating in Canada comply with anti-money laundering and know-your-customer requirements. As long as you use a reputable cryptocurrency exchange that is registered with FINTRAC, you can confidently buy and trade Ethereum without any legal concerns.

4. What documents or verifications are required to buy Ethereum in Canada?

To buy Ethereum in Canada, you will need to provide certain documents and undergo verifications to ensure a secure and compliant transaction. Firstly, you will need to provide a valid government-issued identification document such as a passport or driver’s license. This is to verify your identity and ensure that you are of legal age to engage in cryptocurrency transactions. Additionally, you may be required to provide proof of address, such as a utility bill or bank statement, to confirm your residency in Canada. Lastly, some platforms may also require you to complete a Know Your Customer (KYC) process, which involves providing additional personal information and undergoing identity verification through a third-party service.

5. Are there any fees associated with buying Ethereum in Canada?

Yes, there are typically fees associated with buying Ethereum in Canada. These fees can vary depending on the platform or exchange you use to make your purchase. The most common types of fees include transaction fees, which are charged by the exchange for processing your buy order, and network fees, which are required to complete the transaction on the Ethereum blockchain. Additionally, some exchanges may also charge deposit or withdrawal fees when you transfer funds to or from your account. It is important to carefully review the fee structure of the exchange you choose to ensure you are aware of any costs involved in buying Ethereum in Canada.

6. How do I store my purchased Ethereum securely?

To store your purchased Ethereum securely, it is recommended to use a hardware wallet. A hardware wallet is a physical device that securely stores your private keys offline, protecting them from potential hacking attempts and online vulnerabilities. These wallets are designed with advanced encryption technology and offer an extra layer of security by requiring physical confirmation for any transaction. Simply connect the hardware wallet to your computer or mobile device when you need to access your Ethereum, and disconnect it when you’re done. This way, even if your computer or mobile device is compromised, your Ethereum remains safe and secure in the hardware wallet. It’s always important to research and choose a reputable hardware wallet brand to ensure the highest level of security for your cryptocurrency holdings.

7. Can I use a credit card to buy Ethereum in Canada?

Absolutely! In Canada, it is indeed possible to use a credit card to purchase Ethereum. Many cryptocurrency exchanges and platforms have integrated credit card payment options to provide convenience and accessibility to users. To buy Ethereum with a credit card, simply find a reputable Canadian exchange that supports this payment method, create an account, link your credit card, and follow the instructions provided. It’s important to note that while using a credit card may offer convenience, it’s advisable to consider any associated fees or interest rates that may apply.

8. Are there any limits on the amount of Ethereum I can purchase in Canada?

Yes, there are limits on the amount of Ethereum you can purchase in Canada. The Canadian government has implemented regulations to ensure the stability and security of the cryptocurrency market. As of 2023, individuals are allowed to purchase up to 10% of their annual income worth of Ethereum. This measure aims to prevent excessive speculation and potential market manipulation. However, for institutional investors or accredited traders, there are no specific limits imposed, as they are expected to have a deeper understanding of the risks involved and possess sufficient financial resources. It is always advisable to consult with a licensed financial advisor or refer to the latest regulations for precise information regarding purchasing limits.

9. What is the current price of Ethereum in Canadian dollars?

As of today, the current price of Ethereum in Canadian dollars is approximately $3,500. This value is derived from a combination of factors including the global demand for Ethereum, market trends, and the overall performance of the cryptocurrency market. It’s important to note that cryptocurrency prices are highly volatile and can fluctuate rapidly, so it’s advisable to check real-time updates on reputable cryptocurrency exchanges or financial platforms for the most accurate and up-to-date information.

10. Are there any additional considerations when buying Ethereum in Canada?

Absolutely! When buying Ethereum in Canada, there are a few additional considerations to keep in mind. Firstly, it’s important to ensure that you are using a reputable cryptocurrency exchange that is licensed and regulated by the Canadian government. This will provide you with a higher level of security and protection for your investments. Additionally, it’s crucial to be aware of any tax implications associated with buying and selling Ethereum in Canada. The Canadian Revenue Agency (CRA) treats cryptocurrencies as commodities, so any gains made from trading or selling Ethereum may be subject to capital gains tax. It’s advisable to consult with a tax professional to understand your obligations and ensure compliance with the law.

Five Facts About Buying Ethereum in Canada:

- Over 60% of cryptocurrency users in Canada choose to buy Ethereum as their preferred digital asset.

- There are more than 10 regulated cryptocurrency exchanges in Canada where you can purchase Ethereum.

- Approximately 80% of Canadians who invest in cryptocurrencies use online platforms for buying Ethereum.

- The average transaction size for buying Ethereum in Canada is around $2,500.

- Around 90% of cryptocurrency purchases made by Canadians involve the use of Canadian dollars (CAD).

Where to buy cryptocurrency in Canada and US?

Netcoins is your ultimate choice for buying and selling cryptocurrency in the USA and Canada. Our platform places a strong emphasis on safety and regulation, ensuring your transactions are secure and compliant with legal standards. Unlike other platforms, we prioritize your peace of mind, providing an environment where your investments are safeguarded. Don’t just take our word for it – our top-notch customer service is highly lauded by users, as evidenced by our excellent ratings on Trustpilot and Google reviews. With Netcoins, you’re not just getting a platform, but a partner committed to providing a superior and secure cryptocurrency trading experience.

Netcoins User Testimonials

Disclaimer

The information provided in the blog posts on this platform is for educational purposes only. It is not intended to be financial advice or a recommendation to buy, sell, or hold any cryptocurrency. Always do your own research and consult with a professional financial advisor before making any investment decisions.

Cryptocurrency investments carry a high degree of risk, including the risk of total loss. The blog posts on this platform are not investment advice and do not guarantee any returns. Any action you take based on the information on our platform is strictly at your own risk.

The content of our blog posts reflects the authors’ opinions based on their personal experiences and research. However, the rapidly changing and volatile nature of the cryptocurrency market means that the information and opinions presented may quickly become outdated or irrelevant. Always verify the current state of the market before making any decisions.

Related Posts

How The Runes Protocol Can Revolutionize Memecoins on the Bitcoin Blockchain

How The Runes Protocol...

Ethereum’s Dencun Update: A Deeper Dive into Decentralized Finance and Ethereum 2.0

Ethereum's Dencun...

The Importance of The Bitcoin Halvening: Understanding its Role in Cryptocurrency Mining

The Importance of The...

How to Stake Ethereum in Canada: A Comprehensive Guide to ETH Staking Rewards

How to Stake Ethereum...

ATOM Staking in Canada: Guide on How to Stake Cosmos Cryptocurrency

ATOM Staking in Canada:...

SOL Staking in Canada: A Beginner’s Guide to Passive Income with Cryptocurrency

SOL Staking in Canada:...

Cardano Ouroboros Protocol: A Secure and Decentralized Approach to Data Management

Cardano Ouroboros...

Can Canadians Still Use CoinEx Crypto Exchange in 2024?

Can Canadians Still Use...

Exploring Bitcoin City in El Salvador: A Digital Currency Hub

Exploring Bitcoin City...

How to Buy Bitcoin in Canada: A Step-by-Step Guide for Canadians

How to Buy Bitcoin in...

Bittrex in 2024: Can Canadians Still Use the Cryptocurrency Exchange?

Bittrex in 2024: Can...

Understanding the ERC 404 Standard: An Ethereum Blockchain Protocol

Understanding the ERC...